The Use of Cryptocurrency for Money Laundering :

Trends, Impact, and Regulations

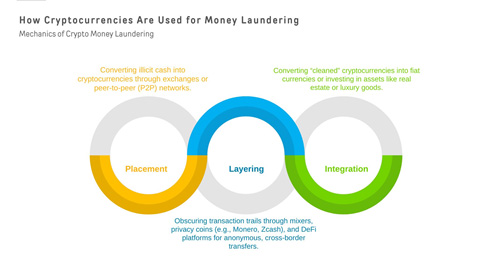

Cryptocurrencies, known for their decentralization and privacy, have emerged as a revolutionary financial tool. However, these same attributes make them attractive for illicit activities, including money laundering (ML) and terrorist financing (TF). In 2024, approximately $14.3 billion was laundered through cryptocurrencies globally, marking a significant increase due to the rise of decentralized finance (DeFi) platforms and privacy coins.

This article explores the mechanics of crypto-based money laundering, its global and regional impact, and the measures taken by regulatory bodies, including FATF recommendations and India’s regulatory response.

Learn more about mixing services and DeFi exploitation: Chainalysis Crypto Crime Report 2024

Impact of Cryptocurrency-Based Money Laundering

1. Financial System Risks

- Undermines trust in financial institutions

- Increases compliance costs for banks and VASPs (Virtual Asset Service Providers)

2. Criminal Exploitation

- Terrorist groups and rogue states use cryptocurrencies to evade sanctions

- Reports indicate that North Korea laundered over $1 billion in stolen cryptocurrency in 2024 to fund weapons programs

Detailed analysis of North Korea’s crypto activities:Chainalysis Crypto Crime Report 2024 [https://blog.chainalysis.com/reports/crypto-crime-2024]

3. Market Volatility

- Criminal misuse impacts legitimate market adoption and increases regulatory scrutiny

Global Regulatory Measures

1. FATF Recommendations

The Financial Action Task Force (FATF) plays a critical role in regulating cryptocurrency. Key recommendations include:

- Recommendation 15: Requires VASPs to implement AML/CFT measures

- Travel Rule: Mandates VASPs to collect and share sender/receiver details during transactions

- Risk-Based Supervision: Jurisdictions must monitor high-risk entities

- Access FATF’s full recommendations: FATF Crypto Guidelines 2024

2. U.S. and EU Regulations

- United States: Under the Bank Secrecy Act, crypto exchanges must report transactions exceeding $10,000. FinCEN Compliance Rules

- European Union: The Markets in Crypto-Assets (MiCA) regulation enforces stringent KYC norms for VASPs. European Commission – MiCA : https://commission.europa.eu/index_en

India’s Approach to Cryptocurrency Regulation

1. AML and Regulatory Framework

- Under the Prevention of Money Laundering Act (PMLA), 2002, cryptocurrency transactions are subject to AML compliance

- RBI mandates KYC verification and UBO (Ultimate Beneficial Ownership) disclosure for crypto platforms

RBI Guidelines: Reserve Bank of India Crypto Circular 2024

2. FATF Compliance

- India has adopted FATF’s Travel Rule, mandating information-sharing for crypto transfers

- FIU-India actively monitors VASP activities

FIU-India Overview: FIU-India Reports

3. Taxation Policies

- 30% tax on crypto gains and 1% TDS on transactions create audit trails, discouraging misuse

Learn more: Income Tax Department of India

Cryptocurrency offers innovation and efficiency but poses serious risks when misused for financial crimes.Regulatory bodies, including FATF, are taking proactive steps to curb crypto-based money laundering. India’s alignment with global standards, coupled with strict taxation and AML frameworks, demonstrates its commitment to combating financial crime

To secure the future of digital finance:

- Governments must harmonize regulations globally

- Financial institutions must adopt advanced compliance tools

- Continuous monitoring and evolving AML measures are essential

Additional Resources:

- FATF’s Crypto Compliance Report: FATF Official Website

- India’s Crypto Tax Guidelines: Government of India

Important to understand the following:-

- VASP regulations & Travel rule

- Implementing a Risk-Based Approaches

- Mitigation Strategies

- Regulatory framework

- Useful tools for Blockchain Analytics & investigations