RESOURCES

Blogs & Updates

FinCEN identified the following red flag indicators to help financial institutions detect, prevent, and report potential suspicious activity related to the use of GenAI tools for illicit purposes.

Source: Deep Fake Indicators by FinCen (FIN-2024-Alert004, November 13, 2024)

https://www.fincen.gov/sites/default/files/shared/FinCEN-Alert-DeepFakes-Alert508FINAL.pdf

RBI’s list of few Early Warning Signals

- Default in payment to the banks/sundry debtors and other statutory bodies, etc., bouncing of the high value cheques

- Raid by Income tax/sales tax/central excise duty officials

- Frequent change in the scope of the project to be undertaken by the borrower

- Under insured or over insured inventory

- Invoices devoid of TAN and other details

- Dispute on title of the collateral securities

- Costing of the project which is in wide variance with standard cost of installation of the project

- Funds coming from other banks to liquidate the outstanding loan amount

- Foreign bills remaining outstanding for a long time and tendency for bills to remain overdue

- Onerous clause in issue of BG/LC/standby letters of credit

- In merchanting trade, import leg not revealed to the bank

- Request received from the borrower to postpone the inspection of the godown for flimsy reasons

- Delay observed in payment of outstanding dues

- Financing the unit far away from the branch

- Claims not acknowledged as debt high

- Frequent invocation of BGs and devolvement of LCs

- Funding of the interest by sanctioning additional facilities

- Same collateral charged to a number of lenders

- Concealment of certain vital documents like master agreement, insurance coverage

- Floating front/associate companies by investing borrowed money

- Reduction in the stake of promoter/director

- Resignation of the key personnel and frequent changes in the management

- Substantial increase in unbilled revenue year after yea

- Large number of transactions with inter-connected companies and large outstanding from such companies

- Significant movements in inventory, disproportionately higher than the growth in turnover

- Significant movements in receivables, disproportionately higher than the growth in turnover and/or increase in ageing of the receivables

- Disproportionate increase in other current assets

- Significant increase in working capital borrowing as percentage of turn- over

- Critical issues highlighted in the stock audit report

- Increase in Fixed Assets, without a corresponding increase in turnover (when the project is implemented)

- Increase in borrowings despite huge cash and cash equivalents in the borrower’s balance sheet

- Liabilities appearing in the ROC search report are not reported by the borrower in its annual report

- Substantial related party transactions

- Material discrepancies in the annual report

- Significant inconsistencies within the annual report (between various sections)

- Poor disclosure of materially adverse information and no qualification by the statutory auditors

- Frequent change in the accounting period and/or accounting policies

- Frequent requests for general-purpose loans

- Movement of an account from one bank to another

- Frequent ad hoc sanctions

- Not routing of sales proceeds through the bank

- LCs issued for local trade/related party transactions

- High-value RTGS payment to unrelated parties

- Heavy cash withdrawal in loan accounts

- Non-submission of original bills

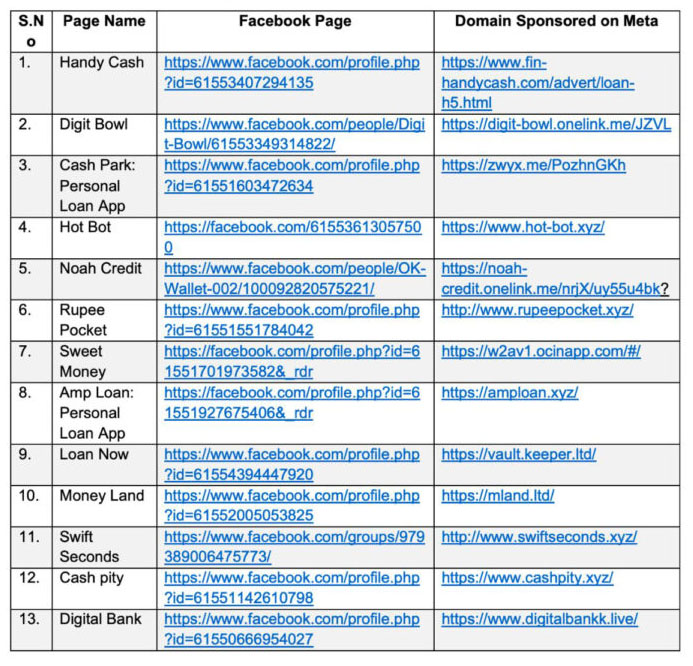

List of Suspicious Loan Apps running campaigns through Facebook Advertisement :

An early warning mechanism to warn the public to invest time and money in MLM frauds listed on the SCAM ALERT list

(https://www.strategyindia.com/blog/scam-alerts/ ) the Strategy India website.

What clients say about our services

Rupeeseed has been a great solution provider for our trading needs especially their trading app is extremely user friendly in terms of the ui/ux and also the trade execution. Rupeeseed has always been extremely forthcoming in taking our suggestions and customising as per our needs.

Hetavi ShahStrategy & New Initiatives, Latin Manharlal

I wanted to take a moment to thank you for the services your team has provided. It has been a pleasure working with you, and we are glad that any minor issues were resolved efficiently. We value your business and hope to continue growing together.

Shabbir RangwalaAGM-Product, Paytm Money

Your team's dedication and professionalism were crucial to the project success.Your responsiveness and flexibility greatly contributed to the smooth execution of the project.Working with RTVL was pleasure.Thank you once again for your excellent support.

Rajeev Ratan SrivastavaMD & CEO Standard Chartered Securities (India) Ltd

Previous

Next