FinCrime Frequency – Global AML Update: What’s Happening Now

The global AML/CTF landscape remains active with enforcement, legislative updates, and supervisory pressureacross multiple jurisdictions. Here’s what’s most relevant right …

FinCrime Frequency – FinCEN Delays AML Rule for Investment Advisers to 2028 What This REALLY Means for Compliance Teams

Investment managers thought January 1, 2026 would be the start of a major change: AML program and SAR filing obligations …

FinCrime Frequency- A Major Korean Cryptocurrency Firm Fined for AML Failures: What Went Wrong – and What Every Compliance Team Must Learn

In recent weeks, a major South Korean cryptocurrency exchange was fined approximately USD 1.9 million by the national Financial Intelligence …

Silent Sanctions Red Flags

Sanctions evasion rarely happens through obvious channels. It hides inside trade flows 4 buried in Letters of Credit, Bills of …

How to Challenge a False Positive Like a Pro

False positives waste time, clog queues, and hide real risk. Clearing them well is a skill: you must be fast, …

FinCrime Frequency – Global AML Scrutiny Intensifies – FATF Review Visit to Canada & FCA Steps Up AML Oversight

1. What Just Happened – Two Big Signals from the AML World Global AML auditors are in Canada right now. …

FinCrime Frequency – Singapore Regulators Fine Multiple Financial Institutions for AML / KYC Failures

What Happened? ⚠️ Red Flags That Were Missed ⚖️ The Consequences 🧠 Lessons for Compliance Teams 💡 Takeaway:

FinCrime Frequency – Patterns in Recent AML Fines: What’s Triggering Regulator Action

Over the past couple of years, regulators globally have ramped up enforcement. Several recurring patterns are emerging in the fines …

FinCrime Frequency – Beyond the Checklist: Smarter Compliance in 2025

Why This Matters Financial crime is evolving faster than ever: All these shifts point to one truth: checklist compliance will …

FinCrime Frequency – The New “50% Rule”: Why It Matters for Global Compliance

The global compliance landscape is shifting again. The U.S. Department of Commerce’s Bureau of Industry and Security (BIS) recently enacted …

FinCrime Frequency – SEBI Pushes for Digital KYC Reforms to Simplify NRI Market Access

What Happened The Securities and Exchange Board of India (SEBI) is prioritizing a major reform — simplifying KYC requirements for …

FinCrime Frequency – Global AML Shake-Up: New SAR Guidance & the Launch of the EU’s AMLA

In this edition, we break down two major global regulatory updates shaping compliance strategy for 2025 and beyond from FinCEN’s …

FinCrime Frequency – FATF’s New “Call for Action” What It Means for Global AML & KYC Programs

What Happened The Financial Action Task Force (FATF) published its October 2025 “Call for Action” and “Jurisdictions under Increased Monitoring” …

10 Scenario-Based Questions on Enhanced Due Diligence

Enhanced Due Diligence (EDD) represents a critical component of robust anti-money laundering frameworks. These scenario-based questions explore practical applications of …

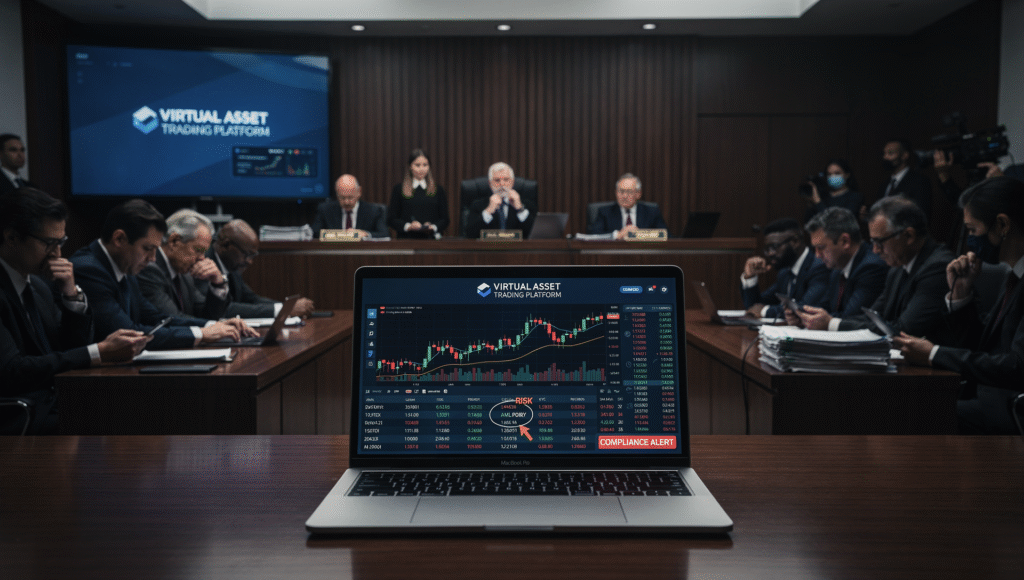

FinCrime Frequency – How a Virtual Asset Trading Platform’s Guilty Plea Redefines AML Expectations in Digital Assets

1. The Enforcement Story – What Really Happened A virtual asset trading platform recently pled guilty in federal court to …

FinCrime Frequency # UK AML Supervision Overhaul for Legal & Accounting Firms

What’s New The UK Treasury has announced plans to move the anti-money laundering (AML) and counter-terrorist finance (CTF) supervision of …

FinCrime Frequency # How the UK’s Latest AML Advisory Quietly Changes KYC Geography Risk

1. The Update On 27 October 2025, HM Treasury (UK) released a revised Money Laundering Advisory Notice instructing all firms …

The risk of secondary sanctions

Sanctions risk today isn’t about who your customer is …it’s about who your customer deals with. Secondary sanctions are now one of …

FinCrime Frequency- When One Branch Breaks the Whole Bank: The AML Lessons No One Talks About

In late 2025, regulators revealed that a bank had uncovered multi-year suspicious activity at a single retail branch and what …

FinCrime Frequency – FATF Update – What It Means for Your Risk Radar & KYC Program

1. What’s New – The Update In short: the global AML landscape has quietly shifted – some jurisdictions are now …