About Us

About Us

Built for Compliance. Driven by Community.

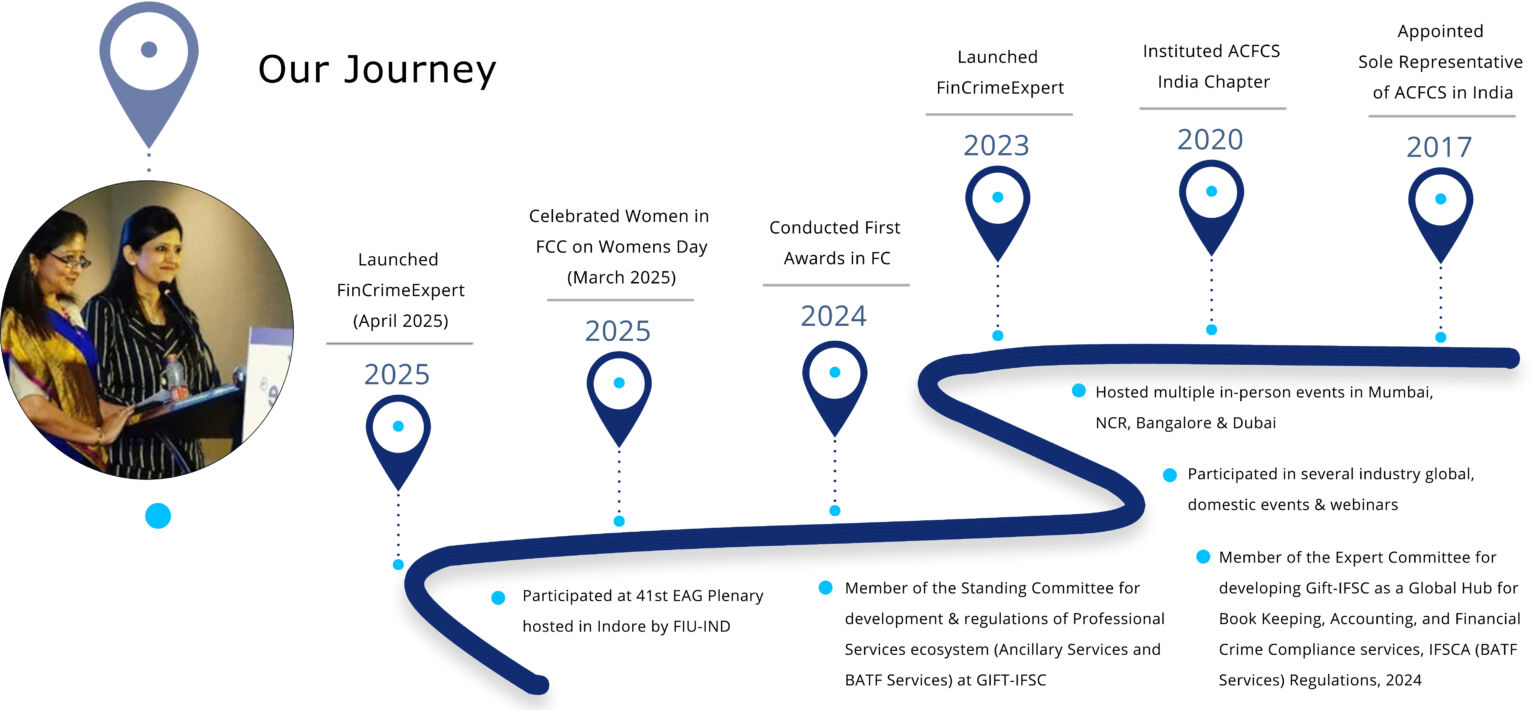

FinCrimeExpert is an inclusive portal built for professionals working across Financial Crime Compliance (FCC) domains to cover all requirements, having an existing network of over 75k professionals.

The portal is managed by Ajcon Group. The Group’s flagship company, Ajcon Global Services Ltd is a three decade-old, well-known, listed company engaged in providing a whole gamut of financial services.

Our Ethos

Guided by Purpose, Driven by Impact

Our team is a diverse group of FCC experts, technologists, and industry leaders. Together, we’re committed to building a safer, smarter compliance ecosystem.

Content

Delivering content to provide holistic knowledge & stay tuned

Curate

Curating need based events, trainings and engagements for all

Context

Deploying the right tools and resources, to contextualize emerging risks & embrace innovations

Community

Building communities by engaging various stakeholders, including law enforcement agencies & regulators

Financial crime has far-reaching consequences, not just for organisations but for entire economies.

Building a robust ecosystem, well aware & well equipped, focused on financial crime prevention facilitates a secure, stable and transparent financial ecosystem, thus building public trust and safeguarding economic growth.

Meet Our Team

Leadership Team

Meet the People Powering FinCrimeExpert

Advisory Team

Vision At FinCrimeExpert

Testimonials

We recently engaged the FinCrimeExpert team to conduct a comprehensive training program for our Forensic teams over 4 days on key areas of financial crime risk—Money Mules, Transaction Monitoring, Red Flag Indicators, Sanctions, Terrorist Financing (TF), and Proliferation Financing (PF).

The insightful sessions explored both regulatory expectations and practical challenges, where the facilitators shared their subject matter expertise using real-life case studies and evolving typologies to highlight red flags, investigative methods, and risk mitigation strategies.

A key takeaway of the session was risk assessment across key areas—customer, product, branch, country, sanctions, and TF exposure—while linking specific red flag indicators to each. The post-session assessments further reinforced learning through discussions on challenges arising from geopolitical tensions, product-based vulnerabilities, and misuse of cross-border structures for round-tripping and tax arbitrage.

We appreciate the FinCrimeExpert team’s collaborative approach, relevant content, delivery, and look forward to future engagements.

Team EY

India

We recently engaged the FinCrimeExpert team to conduct a comprehensive training program for our Forensic teams over 4 days on key areas of financial crime risk—Money Mules, Transaction Monitoring, Red Flag Indicators, Sanctions, Terrorist Financing (TF), and Proliferation Financing (PF).

The insightful sessions explored both regulatory expectations and practical challenges, where the facilitators shared their subject matter expertise using real-life case studies and evolving typologies to highlight red flags, investigative methods, and risk mitigation strategies.

A key takeaway of the session was risk assessment across key areas—customer, product, branch, country, sanctions, and TF exposure—while linking specific red flag indicators to each. The post-session assessments further reinforced learning through discussions on challenges arising from geopolitical tensions, product-based vulnerabilities, and misuse of cross-border structures for round-tripping and tax arbitrage.

We appreciate the FinCrimeExpert team’s collaborative approach, relevant content, delivery, and look forward to future engagements.