The Backdoor Route to North Korea’s Fuel

In one of the most audacious maritime sanctions evasion cases in recent history, Singapore became the unsuspecting node in a covert network that funneled restricted gasoil to the Democratic People’s Republic of Korea (DPRK). This case unpacks how falsified documents, opaque ownership structures, and mid-sea fuel transfers successfully bypassed UN sanctions—until authorities stepped in.

Who Was Behind the Curtain?

- Justin Low Eng Yeow – Director of ISA Energy (Asia), considered the central figure in orchestrating the operation.

- Kwek Kee Seng – Director of Ansafar Trading and Swanseas Port Services, currently on the run; $5 million bounty issued by the U.S. government.

- Benito Aloria Yap & Manfred Low Cheng Jing – Directors of Yuk Tung Energy, jailed for destroying evidence linked to fuel transshipments to DPRK.

Anatomy of the Operation

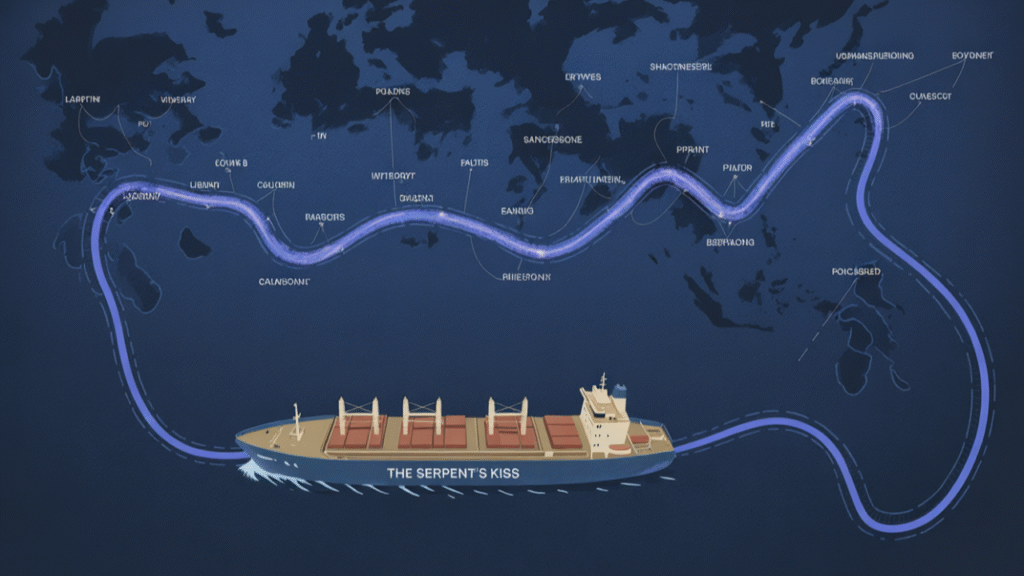

- How it worked: Mid-sea ship-to-ship (STS) transfers, with at least one direct delivery to DPRK’s Nampo Port.

- Volume moved: Over 70,000 barrels of gasoil.

- Payment trail: Funds were routed through falsified documentation, with deposits made to ISA Energy (on four occasions) and another affiliated company (five occasions).

- Cover-up tactics: Included evidence destruction (phones, documents), fake invoices, and suspected AIS manipulation (going “dark” at sea).

The Hammer Falls

Following investigations by Singapore’s Commercial Affairs Department (CAD):

- Justin Low Eng Yeow ▸ Found guilty of facilitating DPRK fuel exports ▸ Sentenced to 12 months and 3 weeks in prison

- ISA Energy (Asia) ▸ Fined SGD 280,000

- Yuk Tung Energy ▸ Investigated for mid-sea transfers ▸ Directors jailed for evidence tampering

- Kwek Kee Seng ▸ Still at large ▸ Charged with 17 counts related to DPRK fuel transfers ▸ MT Courageous vessel seized in Cambodia

What Should’ve Raised Eyebrows

Several red flags were visible in hindsight—and should have triggered scrutiny:

- AIS-dark vessels conducting refueling operations in high-risk waters

- Payments to entities without petroleum trading licenses

- Repeated fund flows through newly formed, opaque companies

- Shared directors and signatories across multiple recipient firms

Individually, each signal could seem minor. Together, they pointed clearly to a coordinated evasion network.

Strategic Takeaways for Compliance Teams

Enhance Vessel Risk Screening Traditional screening isn’t enough. Integrate AIS gap detection, STS activity flags, and vessel tracking to identify evasive behavior proactively.

Trace the Full Fund Trail Don’t stop at the first payee. Map out the entire web of linked entities, following the money through beneficial ownership and relationship networks.

Scrutinize Trade Documentation Be extra cautious with documents that look “too clean.” Cross-check Bills of Lading and invoices for mismatches, vague descriptions, and inconsistencies.

Assess Maritime Exposure Holistically Risk doesn’t lie only in the customer. It could be in their cargo, vessel behavior, or trade routes. Take a wide-angle view of maritime activity.

Why This Case Matters Globally

This wasn’t just a local breakdown. The operation undermined global efforts to curb nuclear proliferation through sanctions enforcement.

Even a well-regulated hub like Singapore was exploited—thanks to gaps in trade finance and maritime due diligence. The case proved that sophisticated evasion tactics can thrive in the shadows of legitimate business.

What turned the tide? Cross-border collaboration. The successful investigation relied on coordination between Singapore’s CAD, the U.S. Treasury Department, and other regional bodies—an essential model for future enforcement.

As global trade grows more complex, so too will the techniques used to circumvent it. Compliance teams must connect the dots early and work beyond borders to stay ahead.